Control and manage

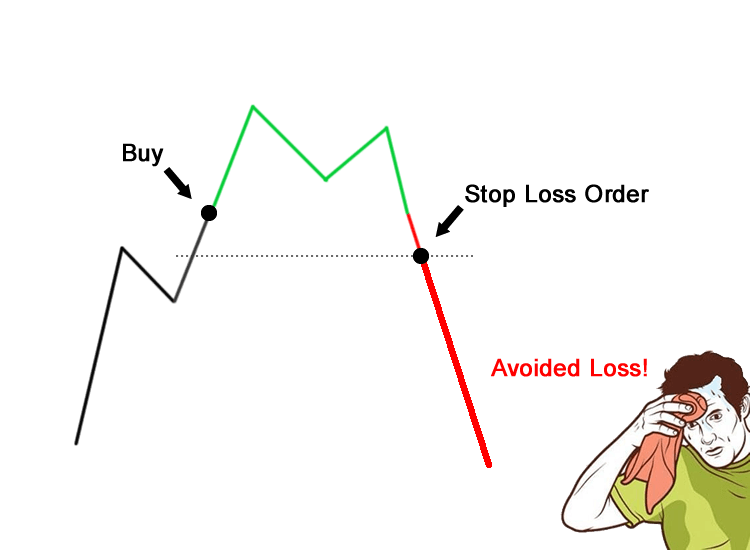

To trade forex successfully, you don’t need to have the genius mind of a wizard and be right in every prediction about the next movement of the market. It is perfectly OK to be wrong about your analysis many times during your trading career. The crucial skill of a successful forex trader is his ability to control and manage his downside effectively. Losses are a natural part of trading, but if you can ensure that they do not derail your overall trading vision, and can be eliminated by the profits of your trades that are successful, a promising and exciting forex career will be the outcome.

Clearly, the careful placement of the stop-loss order is crucial for risk management. To cut your losses short, you must make good use of this basic tool of money management. In the following section we’ll give a few ideas on the various ways of placing the stop-loss order, and you can use any combination of them in forex strategies, in order .

Absolute stop Order

In this kind of order, the trader only concerns himself with the net unrealized profit or loss of his account. However confident he may be in his analytical skills, and the conditions that lead to his trade, the actual performance of the trade always has the final word about the fate of the position. Trader consensus demands that in every trade a maximum of 2.5 percent be risked in order to ensure that there will be ample future opportunities for correcting faulty decisions. Some traders go as far as 5 percent in a bid to be more aggressive about a trade scenario where they feel more confident, and five percent of the account value is probably the greatest extent a sensible trader will go with aggressive risk taking.

Technical Stop

In this case the stop-loss order is triggered when a technical formation is realized. In its most basic form, for example, the trader will close the position when the RSI rises to above 80 in a buy order. This kind of stop-loss order has the advantage of being more flexible in response to market events, but it clearly entails greater risk if things don’t go as planned.

News Stop

This is a rare method used by some traders with long-term positions, and sufficient confidence. In this case, the trader will be willing to ignore most of the volatility in preference for a major change in the fundamental picture. Only an anticipated news release confirming the elimination of the conditions that justified the trade in the first place will trigger a stop-loss order. However, such traders will also monitor the price action carefully, and will not hesitate to bail out if market conditions necessitate it.

For a technical stop, a forex API provided by a competent forex broker offers the greatest potential. For other types of stop-loss orders, trader action will be necessary. In all cases, it is probably best to use a flexible technical stop-order, for example, with an absolute, numerical order to safely insure against an adverse scenario. Through these and similar means, you will be able to limit your risk, and benefit from opportunities as they arise.